Well guys if you are interested in taking a instant personal loan with just adhar and pan card then you are in the right place.

Today I am going to guide you on how you can apply for a easy personal loan just by using your adhar and pan card. You do need to have an active bank account in order to receive the loan amount.

Now a days taking a instant loan is super easy and we don't need to visit baks or finance companies in order to take a loan.

Everything is digital now, and without any physical movement just by using your smartphone you can now apply for a completely digital instant loan within minutes.

As you might know there are thousands of instant loan applications which provides instant loan with only adhar and pan card, but most of them are fake data collection apps you should ignore.

Finding the right best application for taking a easy loan is a tough job. But worry not today I am going to provide you a good application that you can use to take loans with just adhar and pan card.

Pan Card loan Adhar Loan App Features :

Loan Amount: 2000 - 60000 Rupees

App Type: Pan Card Adhar Card Loan

App Size: 17 MB

Play Store Rating : 4.0

User Interface: Simple Interface

Language: English

Loan Approval Status: High Loan Approval Rate

Pre Payment: No Possible Advance Payment

Loan Guarantee: Up to 80% Loan Guarantee

Interest Rate: Around 5% To 18% annually + GST 18% , No Processing Fee

Repayment Period: 1 Months To 6 Months

App Origin: India

Customer care Support: Usually active

Eligibility Criteria: 18+ Indian Resident, phone number, pan card and adhar card and bank statement with recent photograph.

Pre Payment Charges: Nil

Late Payment Charge: 1% Per Day

How To Take Loan From Pan Card Loan Adhar Loan App ? Pan Card loan Adhar loan app se loan kaise le ?

Taking a instant loan with just pan and adhar card is quite easy and I am going to provide step by step tutorial on how you can apply a adhar card and pan card loan.

Before starting I must remind you that your adhar card is a master card which contains your fingerprint data and eye ratina scan data, also your adhar card is linked with your bank account. So it important to keep your adhar card safe.

Always use masked adhar card for taking loans

and after taking adhar card loan must lock your adhar card. In these days adhar card frauds are happening everywhere so to prevent any fraud activity it is recommended to lock your adhar card. You can easily unlock it when you need to verify adhar just by visiting adhar website.

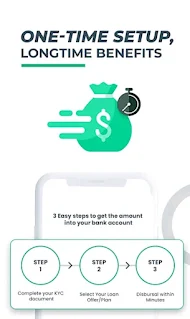

Ok now to apply loan in pan card loan adhar loan app you just need to follow these below steps and you will get a instant loan in your bank account within hours.

1. Install Pan Card loan Adhar loan app.

2. Register with Email I'd and phone no.

3. Complete KYC , upload documents.

4. Choose loan Offer , Read loan agreement.

5. Apply For Loan , wait for approval.

6. E- sign loan agreement using adhar card and choose loan repayment options.

7. Adhar loan at your fingertips.

When your loan gets approved the money will be credited to your bank account. Taking a adhar card pan card loan is as simple as that. If you face any problem while taking loan please write in comments.

Pan Card Loan Adhar Loan App Download :

Pan card loan adhar loan application is available in google play store to download. This application is quite new and have 5k + active downloads with 4 ⭐ user rating. This application is very easy to use and comes with SSL encryption to provide bank level security.

Kindly visit the link below to download the adhar card loan pan card loan application.

Thanks for visiting. Please share this post with your friends and also in social media groups.

0 Comments